9 Startup Funding Sources: Where and How to Get Funding for Your Startup?

Startup Funding Masterclass: Part Two

If you’ve just calculated the runway for your startup and realise that you will need more funding and way sooner than you originally planned, then you’ve come to the right place. 👊

This article aims to provide a comprehensive list of the most common startup funding sources that can lift your startup to success.

This post is Part Three in a new Masterclass series on Startup Funding. Funding is the fuel that every business runs on. Knowing the ins and outs of funding is therefore essential if you want your startup to be successful. We searched for a compact-yet-comprehensive guide on startup funding and found it nowhere, so we decided to build one ourselves. This is that essential guide.

We bring it to you in partnership with Belgium’s largest startup and scale-up accelerator Start it @KBC, supporting and promoting more than 1.000 entrepreneurs with innovative ideas and scalable business models.

– Jeroen Corthout, Co-Founder Salesflare, an easy-to-use sales CRM for small B2B companies

TL;DR 💡

No time to read through the entire article, but still want to figure out what startup funding sources are right for you? 🤔

No worries, we’ve got you covered! You can use the below roadmap to jump through our article and find out what funding sources are best adapted to your company’s specific circumstances.

Do the words early stage, idea phase, or pre-revenue come to mind when talking about your startup?

Are you considering to invest your own savings or talking to friends and family?

Or are you looking for a small outside investment and access to an ecosystem and advice by joining an accelerator or incubator?

Or would you like to get an experienced investor as a shareholder?

Perhaps while doing so you would like to read up on one of the common instruments used in seed investing, the convertible bond?

Are you developing a new technology or thinking about launching a new innovative project?

Have you considered applying for a government grant as a cheap source of funds to support your plans?

Did you hustle your way out of the pre-revenue stage and are you looking for cash to scale your business?

Have you considered keeping all the equity and bootstrapping your way to the top?

Or are you ready to take an outside investor into your shareholder structure?

Is being cash flow positive around the corner, do you need any investments in equipment or are you looking for ways to fund your working capital?

Have you already spoken to any of your local banks? Did you know that there are government programs supporting banks to lend to startups?

Or did you just raise a venture round and are you looking for some extra cash until you go into your next fundraising?

Why don’t you consider what Uber, Airbnb and many others have done before you, and take on venture debt as the bridge between your funding rounds?

Ready for it? Here’s all the details about 9 of the most common startup funding sources! 👇

1. Personal savings

Put your money where your mouth is and go ahead and fund those early steps yourself. Investors will always try to figure out how invested you are in your idea and funding your own startup is definitely a good sign for them.

2. The business itself

The preferred startup funding source: let the business pay for itself and grow your business from the revenue coming in. In reality, this is the best type of funding and it shows that your business is truly taking off. 📈

But your difficulty here is timing, as expenses typically come before revenue. Therefore you need to find a way to get cash up front. A great way to do this is by working with annual plans and prepaid orders.

Growing your business this way will allow you to keep total control and you’ll have a constant reminder of the importance of sales.

It is, however, a tough way to go. Limited resources can severely limit your growth while the pressure of fulfilling promised orders can be immense.

If you have some time, a great read on this is the book Customer Funded Business by John Mullins.

3. Friends and family

Without an established track record or during the early days of your idea, there might not be many people that believe in you, except for your friends and family. 👨👩👧👧

The flexibility to set terms and the belief of the people you know best, make this an attractive source of startup funding.

However, be warned that if not done right this can blow up more than just your business. It can have a lasting effect on your social life. It is not uncommon that friends and family loans result in fallouts, resentment and even lawsuits.

Here are some tips on how to make it work:

Think about the implications

Not everyone is fit to be an investor and money is a strange beast.

Make sure you know the characters of the people involved and try to consider the impact if it all goes wrong.

Would your friendship be at risk, and if so are you willing to risk it?

Be honest with yourself and try to make a rational and thorough assessment.

Manage expectations

You need to be 100% sure about why the funder is helping you.

Are they trying to make a profit, or is it just a gift to get you going? Do they expect their money back anytime soon, or do they see this as a short term fix? Do they want to get involved, or is it hands off from the start?

Also, do not oversell your business. You are probably not speaking to professional investors who are trained to read between the lines and you do not want to come back on your words immediately after the investment.

Protect your friends

Protect your friends from themselves.

Correctly assess if the funder can take the hit if it all goes south. Be honest and open and never ask too much of their money. You do not want to lose a significant portion of your parents’ savings one month before retirement.

Make sure that you understand the financial situation of your funder and their ability to earn back any losses.

Put it on paper

Be clear about the terms and write them down.

Once you’ve established reasonable expectations, negotiate terms and write them down for both parties.

This might sound like overkill to you, but even a simple contract with some clearly established rules will go a long way in preventing disputes later on. Certainly, it also ensures that everyone has thought through the implications and that everyone is on the same page when the money gets handed over.

Over Communicate

You need to manage everyone’s emotions and this requires a lot of conversations.

Working with friends and family might require more communication than with professional investors. Always ensure that your communication is open and clear and that the other party understands what you are talking about. They deserve the same respect and communication as other funders!

Also, make sure that everyone feels included and can speak out, as this will allow you to preempt any issues before they blow up.

Know your tax code

A lot of countries incentivize individuals to make investments in new businesses. Make sure you understand the rules and guide your investors. On the flipside, gifts might result in an unfavourable ruling so watch out you don’t get a tax bill later.

This is definitely worth a trip to your accountant as you should be prepared for some complex questions even by your smallest investor.

4. Government subsidies and grants

Governments are looking to support startups and innovation in their communities. And while the competition is fierce and the criteria are stringent, the access to this relatively cheap startup funding can be an absolute game-changer for your startup. 💸

Grants are very country and region-specific, so make sure to correctly assess the possibilities in your ecosystem.

In general, grants tend to be focused on high tech, science and medicine. They will often be more tailored to specific projects instead of financing an entire business. And they will often require you to match the funds that are given with other funding. Meaning that if the grant is $100,000 that you will have to come up with $100,000 private funding as well.

Additionally, grants often require you to be very detailed on how you will spend the money and will have varying degrees of control mechanisms afterwards.

This also immediately illustrates a key downside of a government grant as an added layer of planning and control might limit your room to pivot later.

Finding the right grant isn’t easy, as they typically are not widely advertised. Talk to other startups in your region or vertical and ask them all about these subsidies. Find the official information of the grants and subscribe to their newsletters so you always know when a new application opens.

Once you’ve found a specific program to apply for, make sure you fully understand the application process as every grant will have their specific deadlines and requirements. Typically a minimum requirement is the following:

- A detailed project description

- An explanation of the benefits of the project

- A detailed cost plan

- Detailed experience and backgrounds of the project managers

Be prepared to spend a lot of time as nearly all information will have to come from you as a founder. And while there are a lot of specialised firms to help you through the process, they are not cheap.

5. Incubators and accelerators

Another way to get startup funding is to go and join an accelerator or incubation program.

While accelerators and incubators are often seen as the same concept, they are not. Both offer a business network, mentorship and some form of a structured program but they have a different purpose.

As TechRepublic puts it: “an accelerator is a greenhouse for young plants to get the optimal conditions to grow, an incubator matches quality seeds with the best soil for sprouting and growth”. 🌱

Accelerators

The best-known accelerators are Y Combinator and Techstars.

The program typically starts with an application round after which successful companies are invited to take part in a specific location. There the companies will take part in an intense mentor program from just a few weeks to a few months.

The accelerator offers a wide network of investors and mentors which can be of tremendous help for building your business and raising future capital. Most accelerators will also end with a demo day inviting investors to see your company. A good example of this approach is the Y Combinator Demo Day, which is seen as a very important day by any Silicon Valley investor.

On the flip side, accelerators are not free. While some provide a fixed amount of startup funding for a small percentage of equity, others will try to include you in their corporate network or might even charge an entrance fee.

Incubators

Most incubators have a shared space in a coworking location, a month-to-month lease program and mentoring with some connection to the local community. That is also why companies will be invited to work in the same location. Here, all companies can learn from each other’s experiences while they refine their ideas, work on their products, product-market fits and business plans.

While not offering any direct startup funding, incubators can be an essential part of bootstrapping your business, as the available space will reduce your expenses while the incubator is full of tips and advice.

Most incubators are run by professional investors, government agencies and major companies. Depending on the sponsor, incubators can be focused on specific technologies, verticals, or even markets.

Over the past few years, there are also increasingly hybrid programs offering an incubator with an accelerator program. A good example of this approach is our partner for this Startup Funding Masterclass, Startit @ KBC.

6. Bank loans

We use banks every day and bank loans are a very common source of startup funding.

So let’s start with the basics: what is a bank loan? 🤔

A bank loan is money that you borrow over a fixed period of time from the bank. Depending on whether you borrow against an asset or not it is called secured or unsecured. Depending on whether the interest rate is fixed upfront or might change depending on certain market changes, it can be fixed or variable.

In order to get a loan, you will need to convince the bank of the viability of your project and your ability to pay back the loan on time without any problems. Your application will be thoroughly reviewed and typically banks will focus on your future cash flows, which is not always a great fit for startups.

Never forget that debt is not the same as equity, as you will need to repay the loans including interest within the agreed time period. Not doing so might lead to bankruptcy; a scenario where the debt holder will always have more claim on the business than the regular shareholders.

Banks offer a lot of products specifically tailored to the needs of a company in all kinds of situations.

It is important to make a clear distinction between loans for short term needs, such as working capital, or more long term commitments like we are speaking of here.

The pros:

- You keep the equity of your business and thus the claim for any future profits

- Banks don’t get involved in how to run your business (as long as you follow the payment terms)

The cons:

- Bank loans are less flexible as they generally stick to their terms along the line

- You will need to pay a fixed monthly amount

- If you fail to pay, it can result in bankruptcy

- Anything you borrow against is at risk and might result in the loss of control

- Variable interest rates might rise at a bad moment

If you decide that a bank loan is the right choice for your business we have some tips on how to successfully get it.

Know what you want

Before talking to a bank, it is critical that you understand how much money you need, what you will use it for, and what kind of terms might work for you and your startup. If you’re unfamiliar with business loans or don’t know they’ll affect your bottom line, you can look online for tools like Keeper’s business loan calculator.

Banks also have a wide range of products depending on your country. Make sure to understand some of the key ones and speak to other entrepreneurs with experience in the matter.

Shop around

Make sure to walk the street and shop around.

All banks have their differences, and whether that might be a lower interest rate or different terms, make sure to look around and find the best one.

Don’t be afraid to use the initial interest from one bank to leverage other banks into making better offers. You might even be able to take different loans in the end, provided they use different collateral.

Be hyper-prepared

Banks get a lot of business proposals so before making your pitch, ask questions about what they will need, and make sure that you bring everything in one package.

Generally, you will need the following:

- A cash flow planning for the duration of the loan and a detailed business plan

- Statistics on revenue growth and composition (client mix, sector mix)

- Materials on your team, sector, track record and investors

- A clear motivation as to why you need the loan

- Your latest financial results to support any assumptions in the materials above

Make sure to go beyond just informing your bank and sell your banker on your plans.

What are government-backed loans?

In a lot of countries, governments are trying to stimulate bank lending to small and medium-sized businesses. A common approach is by guaranteeing part of the loan and thus reducing the risk for the bank.

Government-backed loans are very attractive to new businesses as they typically offer better repayment terms over a longer period of time. While getting them is not that easy, as these loans typically come with strict eligibility requirements, make sure to read up on them before applying.

What is investment credit?

Investment credit is a banking product specifically designed to provide funding for the purchase or development of new equipment or assets. By having a claim on the equipment or assets, the bank can offer lower rates than for other loans. Banks are typically looking to fund assets which yield positive cash flows in the very short term, so take this into account when going in this direction.

What is a line of credit, overdraft or straight loan?

An excellent product if you need credit for expenses to come. As a mix between a corporate credit card and a bank loan, the line of credit provides you with a predefined amount of money that you can draw from as you go along.

Depending on how you can draw the credit it is called an overdraft or straight loan. If you prefer to take the credit in chunks along the way and don’t mind paying a little extra interest, an overdraft is the right choice. If you can draw the line of credit at once, with the advantage of having a lower interest rate, than the straight loan is the way to go.

Common to both options is that you only pay interest from the moment you draw the credit and a litte fee to reserve the total amount up front.

As an example, imagine that you have $10,000 in your account but are required to pay $20,000 in salaries. By having a line of credit or overdraft available you will be able to lend the $10,000 required straight from your account at the predefined rates.

7. Convertible notes

If you are early in the life of your startup and there is very little information, how do you come up with a valuation when talking to investors?

This is a valid question and the reason why convertible notes are a popular startup funding source, as they form the bridge from the first financing needs (seed round) to the later priced (including valuation) rounds. 💡

A convertible note is a short term loan that converts into equity at a predefined event (conversion event), which is typically the next round in which a valuation is established. Convertible notes are useful as they contain limited rights and defer a lot of the complicated negotiations until a later round, which makes it a simple and efficient means of financing.

The amount of equity a seed investor will receive is determined by the following formula:

Amount of equity = Purchase price / Conversion price

Purchase price stands for the initial amount of capital that the investor provided. Sometimes the convertible includes an interest component (accruing interest as long as the note has not been converted) which is then added to the denominator.

The conversion price is the price of the current equity financing round and depends on two additional factors: the pricing discount and the valuation cap.

The pricing discount

In order to reward the investor for taking the risk of funding your startup, convertible notes typically include a pricing discount, which allows a note holder to convert his loan into shares at a discount. These usually range from 10% to 30%.

For example, let’s assume that a startup raised $100,000 in convertible notes with a 20% discount. In the subsequent financing round, the shares are valued at $1.00/share. This means that the seed investor will receive the shares for $0.80/share resulting in $100,000/$0.80 shares or 125,000 shares.

The valuation cap

A second commonly used term is the valuation cap. This is effectively a maximum valuation determined at the time of the convertible note investment at which the investor can convert his loan into shares.

For example, if the valuation cap is determined at $2M and the next round values the company at $4M, the convertible note holder will be able to convert his shares at the $2M valuation receiving an effective (extra) discount of 50%.

Combined, the pricing discount and valuation cap work as following. Say that a startup raised $100,000 funding at a 20% discount and a $2M valuation cap. Later, when a new round of financing is raised, everything with a valuation up to $2.5M will result in a 20% discount. Everything above $2.5M will result in the noteholders converting to equity at a $2M valuation.

If you don’t manage to raise a round before the maturity date of the convertible note, the following can typically happen:

- The noteholder can extend the note

- The noteholder can force you to pay the loan, potentially pushing you into bankruptcy

- The noteholder can convert the note into equity at an agreed valuation

For an excellent summary of some of the more common terms, we refer to the following summary of 500 startups: https://500startups.app.box.com/s/bqhdzjvx8x8fsn8s4zlt

Also, visit their website, for draft legal documents: https://500.co/

8. Venture equity

Equity funding allows you to raise capital without having to pay it back… great! 🙌

But instead of having to repay a loan and having to carry the burden of regular interest payments, you effectively sell part of your business in the form of shares to the investor.

This is a good way to raise a large amount of capital and potentially get smart investors on board. The major downside is the loss of control.

In contrast to a lender you should expect a shareholder to have a view on how to run your business. So make sure to be ready to manage their expectations and advice.

First, the basics. Each share sold represents a unit of ownership of your company. If you issue 2,000 shares and you sell 1,000 shares, the buyer will hold 50% of your company.

This buyer now will have his fair share of all future profits and dividends. She will be rewarded like you do for any share increase down the line.

Depending on the type of shares you issued, the holder will also have voting rights and be part of big decisions, as she will likely have a seat during board meetings.

In general, you can issue two forms of stock: common stock and preferred stock.

Common stock

This is the type of stock people generally refer to if they are speaking about shares and stocks.

Stockholders have a claim on all business profits and dividends while also having voting rights according to their ownership.

It is possible to customise the type of stock that you issue, as you can issue different share classes. An example would be that A class holders have voting rights while B class holders do not. As a private company, a lot is possible and it will all come down to the negotiations with your potential investor.

The most common types, however, are shares with voting rights and shares without voting rights.

Preferred shares

Preferred shareholders have more claim to the firm’s assets than regular shareholders. This is what is referred to as being more senior to regular equity. At the time of liquidation, preferred shareholders will be paid after the debt holders (more senior) and before common stockholders.

In addition, preferred shares often have a fixed dividend and no voting rights.

So where do you go now to sell shares in your business?

In principle, you can go to anyone who is willing to buy them from you, but typically we classify the investors in two groups: Angel Investors and Venture Capital.

Angel investors

An angel investor, in essence, is anyone who is willing to put time and money in your idea.

Angel investors can come from any background and are often former entrepreneurs or venture capitalists. They are motivated by the potential of big returns, the ability to give back to the entrepreneurial community and the ability to provide mentorship to new business owners.

Having a great angel investor can be a gamechanger, as their industry access and knowledge could be an extra enhancement to your team.

A good way to find them is through your personal network, entrepreneurial scene or financial advisors. There are also angel investing networks and websites such as AngelList.

Venture capital investors

Venture capital firms are similar to angel investors but more structured. Instead of dealing with one person, you will now deal with a firm specialised in making startup investments.

Venture firms often rely on outside investors for their capital which makes that they operate in an extremely competitive environment. This makes them more disciplined and demanding.

Compared to angel investors, there are a number of differences.

Venture firms tend to focus more on the business than on the entrepreneur. Where angel investors only have an elevator pitch and the entrepreneur to go by, the venture firm typically has access to a fully fledged business plan and some initial track record.

Typically venture funds commit more capital while also demanding more control. As the amount of money rises so do the stakes and venture firms will put in more effort to follow up on their investment and intervene when needed.

There is also an increased focus on return. Angel investors are certainly not nonprofits, but as venture firms typically rely on outside funding they are way more focused on landing big returns. This makes that they are more engaged and aggressive than the typical angel investor and work in a shorter time frame.

In summary the angel investor invests in an idea and hopes that it will become a business. Venture firms invest in a business and hope it will become huge.

9. Venture debt

While venture equity is a common and attractive source of startup funding, it always requires you to give up part of your business. That is why debt financing is so attractive as you get to keep your equity.

But banks, the biggest debt providers, are very conservative and startups don’t exactly fit in their type of analysis, making access to debt financing difficult. 😅

That is where specialised venture lenders come into play, as they specialise in providing loans to companies with venture funding.

In many ways, these venture loans look and feel like regular bank loans but there are some important differences.

First of all, there is a difference in the analysis done by the lender. Bank lenders tend to look at your revenue and cash flow numbers in order to assess whether you are capable of paying back the loan.

This is not possible for a lot of startups, so venture lenders specialise in assessing other factors such as the quality of investors, the business plan, the capital strategy, and the quality of the team and technology.

Then there is a difference in collateral. Where banks rely on items such as machines, building and equipment, venture lenders tend to rely on intellectual property as a form of collateral.

Additionally, the venture lenders ask for warrants to sweeten the deal. Similar to stock options the warrant allows the holder to acquire shares at a later stage at a set price, creating another financial incentive to the lender. If they would rely only on interest to yield their returns, this interest would be far too expensive.

You made it through the whole list? Congratulations 🎊

You now know the basics about a whole list of startup funding sources, which will help you find all the necessary resources to build your company!

Got the different types of startup funding down? Let us know if you have any questions left; we’ll be happy to elaborate! Also, don’t forget to tune in next week for Part Three in our Startup Funding Masterclass: When to Raise VC Money (and when not to)!

Or check out this summary of the Startup Funding Masterclass.

At this stage you’re probably serious about getting investment and need to keep track of your investment opportunities, which you can do in Salesflare.

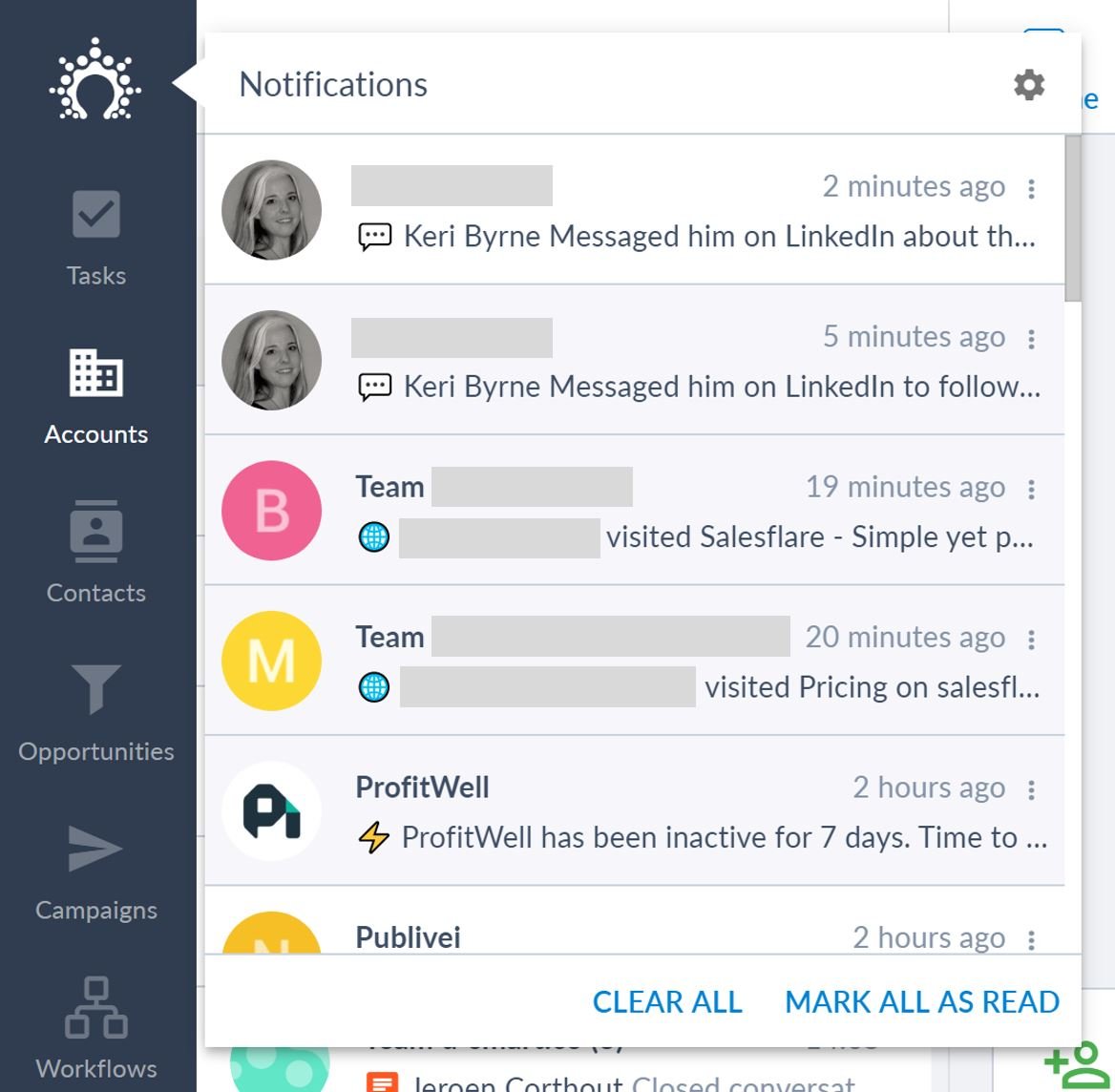

Raising funding (from investors, banks, and the like) can be stressful, especially if you have no insight into what the other party is doing exactly.

Do your potential funders actually open your emails and when do they? Does it happen often or do they do this just once and then forget about you for a while? Do they click on the links towards the materials you’ve sent them, or not at all? Do they maybe check out your site?

To get some insight into this black box, we use our own software, Salesflare, to follow up these relationships.

We use it to keep track of whether they open our emails, click our links, visit our site. And we get notifications on our computer and phone when they do.

And if you’re dealing with multiple investors at the same time, it goes way beyond that:

– Salesflare offers you an overview of which funding deals is in which stage

– You can automatically keep track of all the emails you exchanged and meetings you had

– Took notes? Drop them in the timeline to keep them in one place

– Exchanged files with investors? Salesflare automatically keeps track of all those for you

– And Salesflare also helps you to follow up with investors at the right times, by creating automated reminders (in the form of suggested tasks)

If you’re tired of not knowing what investors are up to and/or could gain from better organizing your funding pipeline, give Salesflare a try. It’s set up in minutes and you’ll be on your way to professionally approaching investors and securing funding.

And, hey, following up investors is not the only thing you can organize in Salesflare. You can obviously also follow up customers, partnerships, resellers, … It’s all a sales process in some way!

By the way, if you’re in a pre-seed stage, you can always contact us on the chat on our homepage or by email to inquire about our early stage program. That way you can get started without breaking the bank! Ping us for the details on how to apply.

By the way, if you’re in a pre-seed stage, you can always contact us on the chat on our homepage or by email to inquire about our early stage program. That way you can get started without breaking the bank! Ping us for the details on how to apply.

Last updated:

- Startup Funding: Where to Get it & What to Look Out for - October 3, 2023

- How to Nail Your Investor Pitch and Get Funded - February 20, 2020

- How to Make the Perfect Pitch Deck - February 13, 2020